Business vehicle depreciation calculator

The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. Auto depreciation calculator Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years.

Depreciation Of Vehicles Atotaxrates Info

Depreciation on the New Vehicle.

. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. Depreciation limits on business vehiclesThe total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or. R10 99583 x 11 x 112 R10080.

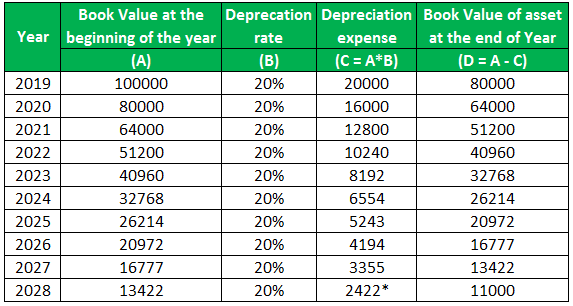

This calculator is for. Depreciation formula The Car Depreciation. The calculator allows you to use Straight Line Method Declining Balance Method Sum of the Years Digits Method and Reducing Balance Method to calculate depreciation expense.

To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for. Basis of your car. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment.

Bloomberg daybreak middle east. Vehicle bought on 1 April 206 during the financial year therefore 1 month of depreciation. May 04 2020 To figure out how much you can deduct you can use a handy depreciation calculator.

510 Business Use of Car. Using the Car Depreciation calculator. Car Depreciation Calculator Good Calculators.

12180 divided by 35880 x 100 3394 thats the depreciation rate Using this formula its a. The formula for depreciation rate is 1- salvage value WDV as on 31032014 1 remaining period of useful life100. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

If youd rather figure out things by hand use this equation. 8 Methods to Prepare Depreciation Schedule in Excel 1. 6 hours ago The Car Depreciation Calculator uses the following formulae.

Vehicle bought on 1 April 206 during the financial year therefore 1 month of depreciation. If a vehicle is used 50 or less for business purposes you must use the straight-line method to calculate depreciation deductions instead of the percentages listed above. If a vehicle is used 50 or less for business purposes you must use the straight-line method to calculate depreciation deductions instead of the percentages listed above.

The total amount you can take as section 179 deductions for most property including vehicles placed in service in a specific year cant be more than 1 million. SLD is easy to calculate because it simply takes the. To find out how much motor vehicle depreciation you can claim contact BMT on 1300 728 726 or Request a Quote.

35880 new- car value - 23700 car s current value 12180. If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits.

A P 1 - R100 n. Alternatively if you use the actual cost method you may take deductions for. R10 99583 x 11 x 112 R10080.

Where A is the value of the car after n. Aug 24 2022 If you use this method you need to figure depreciation for the. Depreciation on the New Vehicle.

D P - A.

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Schedule Template For Straight Line And Declining Balance

Annual Depreciation Of A New Car Find The Future Value Youtube

Car Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Depreciation Calculator

Macrs Depreciation Calculator Irs Publication 946

Depreciation Calculator Definition Formula

Depreciation Of Vehicles Atotaxrates Info

Depreciation Formula Calculate Depreciation Expense

Car Depreciation Chart How Much Have You Lost Infographic New Cars Infographic Financial Tips

Depreciation Of Car Word Problem Solution Youtube

Macrs Depreciation Calculator Irs Publication 946

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Car Depreciation Rate And Idv Calculator Mintwise

Komentar

Posting Komentar